Are you talking with an honest person or someone who’s an expert at deceiving? This is a tricky question to answer, especially for financial transactions. Luckily, PayPal FNF and GNS are here to protect you from these fraudulent activities.

This article will provide a basic understanding of PayPal FNF and GNS. Once finished, you’ll be able to know their difference, benefits, and drawbacks. Tips are also provided on using PayPal safely and methods to reduce PayPal fees.

Learn all of these, and you’ll undoubtedly use PayPal wisely.

What Is PayPal?

It’s an example of a fintech company. They operate by providing you with online payment systems. On top of that, you can also send and receive money without the need for paper money — cashless payments are increasing, and they help the economy grow.

Can I Be Scammed through PayPal?

Unfortunately, scams still occur on PayPal. However, this is avoidable when you understand the difference between PayPal FNF and GNS. Once you know how they differ and when to use them, you’ll be able to notice red flags. Thus, avoiding scams.

What’s the Difference Between PayPal FNF and GNS?

One is for personal use while the other is for business. Both PayPal FNF and GNS are acronyms. They stand for PayPal Friends and Family (FNF) and Goods and Services (GNS).

Now, do you already have a general understanding of how they differ? If not, that’s fine because I’ll thoroughly explain the different uses of both PayPal FNF and GNS for you.

When to Use PayPal FNF and GNS?

Use PayPal FNF if you trust the person you’re sending money to, and opt with PayPal GNS if you’re skeptical about the person. Some sellers, like freelancers, suggest you send money through PayPal FNF. I’m afraid I have to disagree, especially if you don’t know them well.

There’s a good and bad reason for their suggestion: You either avoid PayPal’s fees or get scammed.

No matter what sellers say, always choose PayPal GNS for business purposes. To emphasize this, PayPal even discourages sellers from asking buyers to send money using FNF instead of GNS in their user agreement.

You must not ask your buyer to send you money using the “send money to a friend or family member.” If you do so, PayPal may remove your PayPal account’s ability to accept payments from friends or family members.

PayPal’s User Agreement

As the name suggests, PayPal FNF should only be used for friends and family. It’s used to transfer funds and other personal use. It sounds nice to do this without paying fees, right? Well, you’re in luck.

Using PayPal FNF instead of PayPal GNS prevents transaction fees — this only applies if money isn’t sent internationally. And if you think this is the only reason to use PayPal FNF, you’re in for a surprise!

Pros and Cons of PayPal FNF and GNS

To quickly determine whether you should choose PayPal FNF or GNS, here’s a table showing their pros and cons:

PayPal FNF

| Pros | Cons |

| Great for Sending Digital Gift Cards | No Refunds |

| No Fees for Domestic Transactions | Charges Fees for International Transactions and Using Debit/Credit Card |

PayPal GNS

| Pros | Cons |

| Ensures a Safety Transaction for Sellers and Buyers (Covered by PayPal’s Purchase Protection) | Charges a Fee for Every Transaction |

| Full Refund Is Allowed | No Partial Refunds (If the Buyer Used a Coupon or Gift Certificate for the Transaction) |

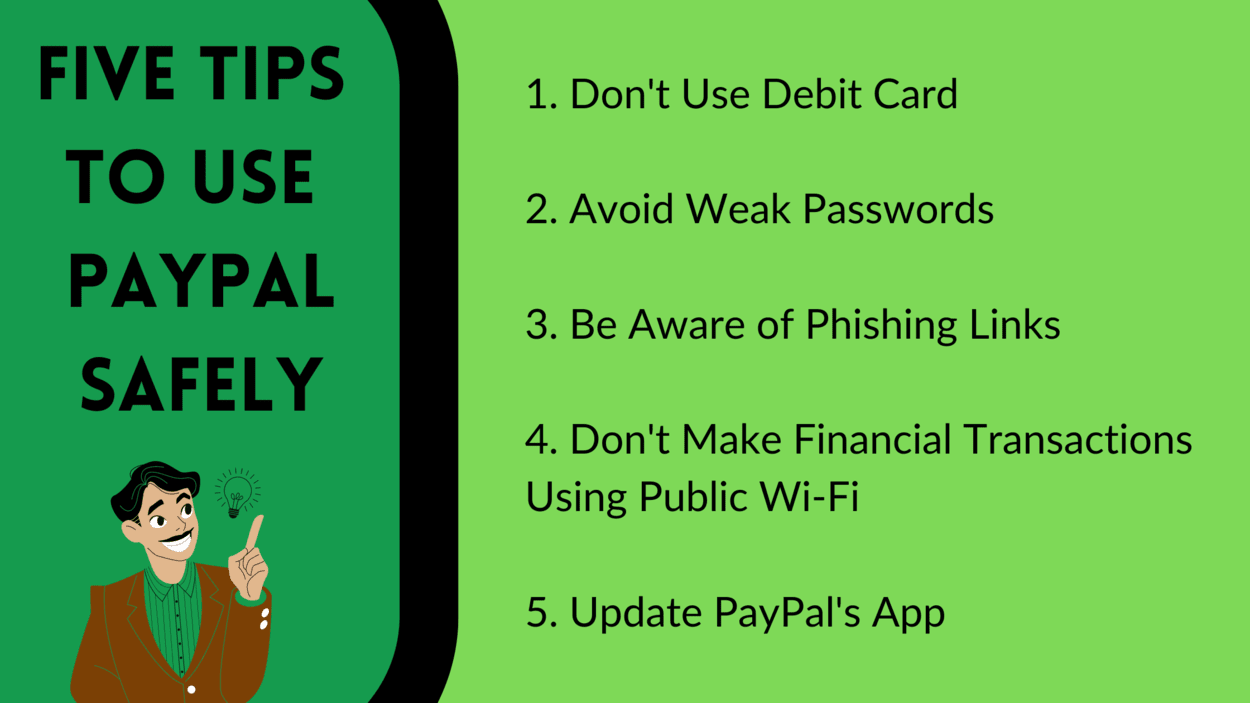

Five Tips to Use PayPal Safely

There are other ways to use PayPal safely than learning about the difference between PayPal FNF and GNS. Use this to your advantage to avoid costly mistakes.

- Don’t use your debit card. PayPal requires you to either link your debit or credit card. Choose credit card as it’s a safer option. When something goes horribly wrong with PayPal, your money will be gone have you used a debit card. Linking a credit card, on the other hand, allows you to refute charges and prevent cybercriminals from illegally accessing your bank account.

- Avoid weak passwords. Treat your PayPal as a bank account. You have your hard-earned money in there, and the last thing you want is for it to be stolen. Create a strong password by adding uppercase and lowercase letters, symbols, and numbers. Do this, and you’ll have peace of mind with your PayPal account.

- Be aware of phishing links. This is just one of the many ways scammers get access to your PayPal account. Your best defense here is to observe if the emails you receive are really from PayPal. Please read them carefully as scammers are getting more thoughtful and innovative with their schemes.

- Don’t make financial transactions using public Wi-Fi. This is not to say you should never use public Wi-Fi. However, cybercriminals can easily hack you when you’re using unsecured public Wi-Fi. They either do this by intercepting your transaction or tricking you with a plausible website. As much as possible, use your mobile data for PayPal to be safe.

- Update PayPal’s app. Outdated software is prone to cybercriminal activities. By constantly updating PayPal’s app, your money is protected with a better security system.

How Can I Lower My PayPal GNS Fees?

Combine payments you receive to lower transaction fees. PayPal charges you by taking a percentage (3.49%) from the money sent with a fixed price ($0.49) for each transaction. By being strategic, you’ll save money from the payments you receive. Here’s how:

Let's say you receive $100 per week from your work — that's $400 per month. Option 1: ($100 x 3.49%) + $0.49 = $3.98 (Fee per Transaction) $3.98 x 4 (Weeks) = $15.92 (Total Fee) Option 2: ($400 x 3.49%) + $0.49 = $14.45 (Total Fee)

See how you reduce fees when you combine payments? It might not be a lot, but the important thing here is you save money during transactions.

Fees get higher when a transaction happens internationally. PayPal’s payments differ from country to country. However, there’s a great way to avoid these hefty fees. Here’s a video to show you how that’s possible:

Alternatives to PayPal

PayPal is just one of the many digital payment systems in the fintech market. Their competitors have unique features, and some even have lower fees than PayPal. To make life easier for you, here are some of the many alternatives to PayPal:

Final Thoughts

PayPal FNF and GNS are used for a unique purpose. Knowing how they differ to save money and prevent scams is essential.

If you’re sending money to someone you trust, use PayPal FNF since there are no fees included when you choose this payment method unless you ship money internationally or use a debit/credit card. However, PayPal GNS is ideal for commercial purposes since it allows refunds.

Not using PayPal FNF for business helps you use PayPal safely, but there are other ways, too, like not linking your debit card, avoiding weak passwords, and updating their app regularly. If your main concern about PayPal GNS is fees, you’d be pleased to know that you can avoid those hefty fees by using Wise to reduce international costs or combining payments to avoid multiple fees.

With all of these in mind, you’ll be able to use PayPal safely and effectively.

Read Other Articles Here:

- Polo shirt vs. Tee shirt (What’s the difference?)

- Difference Between 1st, 2nd, and 3rd Degree Murder

- Low Heat VS Medium Heat VS High Heat in Dryers

Click here to learn more about these differences by viewing the web story.