What is the meaning of the terms ROI and ROIC? Both terminologies are used for investing. Before we get to the topic, let me define investment and its importance.

Investment is a successful and effective method to put your savings or money to work and create a secure future. Make smart investments that may allow your money to outperform inflation and boost value in the future.

Investments generate income in two ways. First, if investing in a profitable asset, we earn income using profit, such as bonds with a fixed amount or percentage of return. Secondly, if an investment is made in the form of a return-generating plan, we will earn an income through an accumulation of gain such as an actual or real state.

It doesn’t give a fixed amount yearly; its value appreciates for a long time. According to the above-mentioned criteria, investments are all about putting savings into assets or objects that become worth more than their initial worth.

ROI, or return on investment, is a term used to describe how much money a business makes from its investments. ROIC, or return on invested capital, is a more precise metric that takes into account a company’s earnings and investments.

Let’s get into the details and discover the differences between ROI and ROIC.

Types of Investments

The investments are classified into two groups, which include induced investments and autonomous investments.

1. Induced Investments

- Induced investments are assets that depend on revenue and are directly inclined by income level.

- It is income elastic. It increases when income increases and vice-versa.

2. Autonomous Investments

- These types of investments refer to investments that are not affected by changes in the income level and are not induced solely by the profit motive.

- It is inelastic and not influenced by changes in income.

- The government generally makes autonomous investments in infrastructural activities. It depends on the country’s social, economic, and political conditions.

- So, such investments change when there is a change in technology or the discovery of new resources, growth of population, etc.

What is an ROI?

The word ROI is an abbreviation of return on investment. It is the profit earned from any investment in marketing or advertising.

The term ROI means different things to different people, often depending on perspective and what is being judged, so it’s important to clarify if interpretation has profound implications.

Many business managers and owners use the term generally to assess the merits of investments and business decisions. Return means profit before tax but clarifies with the person using the term that profit depends on various circumstances, not least the accounting conversations used in the business.

In this sense, most CEOs and business owners regard ROI as the ultimate measure of any business proposition; after all, it’s what most companies aim to produce: maximum return on investment. Otherwise, you might as well put your money in a bank savings account.

In other words, this is the profit made from an investment. The investment could be the value of a whole business, generally regarded as the company’s total assets with a cost attached.

Why Do We Need to Calculate ROI?

A common financial statistic for assessing the likelihood of a return on investment is ROI. The formula to calculate ROI formula is as follows:

Return On Investment = Net Income / Cost of Investment

We calculate ROI for the following reasons:

- To determine the health of the distributor’s business

- To determine if the distributor can support the infrastructure

- To determine the drivers of ROI and unproductive costs & investments that impact ROI

Healthy ROI

The distributor is an entrepreneur who is investing his own time and money in the business and expects a return.

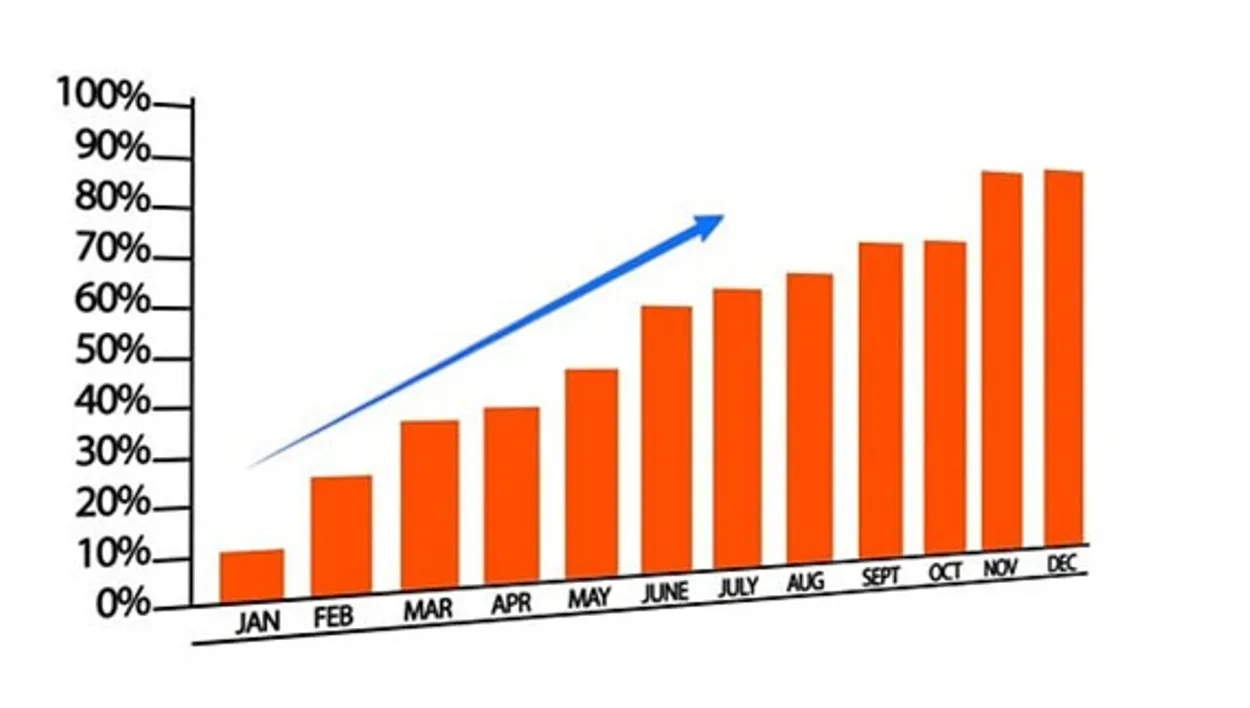

The above graph mentions the return vs. risk metric. It is similar to the stock market if you have a large cap, where the risk is shallow and the recovery would be lower. In minor cases, the risk and return are also high.

Component of ROI

The first component is the income of the distributor. Second are the expenses, and third are the investments. These three elements are calculated to find ROI. So, under income margin, cash discount, and DB incentives are included.

Then the metrics under the expenses are CD to trade, go down rent, workforce salary, accounting, and electricity. Lastly, investments count stock in go down, market credit, vehicle depreciated value, and average monthly claim.

Benefits of ROI

Roi has its advantages and benefits. Some of them are:

- ROI helps to calculate the profitability and productivity of a particular investment plan.

- It also helps in the comparison between two investment plans. (With the help of formula one)

- Using the ROI formula, it is easy to calculate the revenues of different investments.

- It is the globally accepted financial metric and helps you choose the best plan for investments.

What is ROIC?

ROIC stands for return on invested capital. It is a financial metric that finance uses to analyze the revenue of a company’s current investments and growth prospects.

ROIC also helps evaluate a company’s allocation decisions and is commonly used for compression with a company’s WACC (weighted average cost of capital).

If a company has a higher ROIC, it has a strong economic moat capable of generating optimistic investment returns. Most benchmark companies use the ROIC to calculate the value of other companies.

Why Do We Calculate ROIC?

Companies need to calculate ROIC because:

- They need to understand profitability or performance ratio.

- Measure the percentage return an investor in a company earns from their invested capital.

- It shows how efficiently a company uses the investor’s funds to generate income.

There are several ways to calculate ROIC.

- Net Operating Profit After Tax (NOPAT)

ROIC = Invested Capital (IC)

Where:

NOPAT = EBITX (1-TAX RATE)

Invested capital is the total amount of assets a company requires to run its business or the amount of financing from creditors and shareholders.

To run the operations of the company, shareholders give equity to investors. Analysts review the company’s current long-term debt policies, debt requirements, and outstanding capital occupancy or rent obligations for total debt.

- The second way to calculate this value, subtract cash and NIBCL (non-interest-bearing current liabilities), tax obligations, and accounts payable.

- A third method to calculate ROIC, add the total value of company equity to the book worth of its debt and then subtract non-operating assets.

Determining a Value of a Company

A company can estimate its growth by comparing its ROIC to its WACC and observing its return on invested capital percentage.

Any company or firm that earns excess revenues on investments more than the cost of receiving the capital is known as a value creator.

Consequently, an investment whose returns are equal to or less than the cost of capital, this value is called destroyed. Generally, a firm is considered a value creator if its ROIC is at least two percent higher than the cost of capital.

Healthy ROIC

What is a good ROIC? It is the method to determine the company’s defensible position, which means it can protect its profit margins and market share.

ROIC objectives for calculating the metrics for a better understanding of the company’s efficiency and preparing to utilize its OC (operating capital).

The companies in the stock market with a definite moat and a constant need for their ROICs are more accessible. The ROIC concept inclines to be prioritized by stockholders because most investors buy shares with the approach of a long-term holding.

Advantages of ROIC

There are some significant advantages of ROIC are:

- This financial metric helps improve the gross margin on equity and debit. So, it invalidates the impact of capital structure on profitability and productivity.

- ROIC indicates worth creation and conception for the investors.

- Investors prefer to return on invested capital because of the valuation of the inclusive speculation re-occurrence of a company.

- According to the investors, ROIC considers a convenient financial metric.

Difference Between ROI and ROIC

| ROI | ROIC |

| ROI means a return on investment; a firm or company makes money. | ROIC means the return on invested capital measures a company’s investment and income. |

| ROI is calculated by: ROI = income – expense divided by 100 | ROIC is calculated by: ROIC = net income – total capital invested |

| It helps to figure out the rate of cost-effectiveness and profitability. | It helps to understand the company’s gross margin and growth. |

| ROI assists include planning, budgeting, controlling, evaluating opportunities, and supervising. | ROIC work on gross margin, revenue, depreciation, working capital, and fixed assets. |

Which is Better, ROI or ROIC?

ROI and ROIC are different from each other, and both have their advantages. ROI is defined and measured by how much profit is gained on investments, while ROIC is a specific measurement of a company’s income and assets.

Why Does a Bank Don’t Need ROIC?

Banks are exempt from ROIC regulation because they work with many burrowed principals.

What is a Good ROIC Ratio?

A good ROIC ratio is a minimum of 2%.

Conclusion

- ROI is a measure to understand how a company makes how much money on investments, and ROIC is a specific measure of investment and income of the company.

- ROI is a strategy that shows or indicates how well investment and project turn out. ROIC is a financial metric offering investors how efficiently companies work and grow.

- ROI is a generic metric. It is used to compare the efficiency and productivity of different investments with each other. ROIC is compared with WACC to evaluate whether a firm is creating or destroying value.

- ROI and ROIC are both used to measure the profitability and efficiency of a firm, company, or project.