It is impossible to know a person who doesn’t know about Bitcoin or cryptocurrency, or anyone who has been a part of the process.

A digital currency that is decentralized and accessible through various channels is called Bitcoin. The blockchain is a distributed ledger that records currency transactions.

The process of purchasing and selling cryptocurrency is made simple by Robinhood and Coinbase, but there are some significant distinctions between the two services.

It’s simple to purchase a cryptocurrency using Robinhood. While Coinbase concentrates on buying cryptocurrencies with a number of fiat payment methods, such as debit cards and PayPal, you only need to choose which coin you wish to buy before starting the transaction.

Keep reading to know more differences between Robinhood and Coinbase, as well as how they operate the Bitcoin process for users.

What Is Cryptocurrency?

The technology that makes cryptocurrencies possible is called a blockchain. It is a peer-to-peer network’s decentralized ledger of all transactions.

Cryptocurrencies were known for a long time but their popularity rose in around 2019 when the amount exceeds 1600.

A cryptocurrency is a string of information that has been encoded and used as a medium of trade. For instance, Bitcoin was created largely as a means of payment that isn’t distributed or managed by a centralized authority.

Peer-to-peer networks called blockchains keep track of and organize Bitcoin transactions like buying, selling, and transferring while also serving as secure transaction ledgers.

Cryptocurrencies are created by mining, a process that employs computational power to resolve challenging mathematical puzzles that validate transactions on the blockchain, the open ledger of all cryptocurrency transactions.

Benefits Of Cryptocurrency

The cost of a cryptocurrency transaction is often negligible or nonexistent, as opposed to, for instance, the cost of transferring money from a digital wallet to a bank account.

Crypto transactions are generally not time-limited and are unrestricted for both withdrawals and purchases. In contrast to opening a bank account, which requires paperwork and other documentation, almost anyone can utilize cryptocurrency.

International cryptocurrency transactions are swifter than wire payments as wire transfers usually take about half a day to move money between locations.

What Is Bitcoin?

The goal of the digital currency known as Bitcoin is to eliminate the need for centralized organizations like banks or governments.

The blockchain technology used by Bitcoin, on the other hand, enables user-to-user transactions on a decentralized network.

It was introduced in 2009 by an enigmatic programmer known only as Satoshi Nakamoto, and it is still the most valuable asset in the new class of assets known as cryptocurrencies.

The smallest unit of currency in each Bitcoin is called a Satoshi, also the name of the person who created it.

Fractional ownership of Bitcoin is quite common because each Satoshi is equal to a hundred millionth of a Bitcoin.

| Elements | Function |

| Private and Public Keys | It has a public key and a private key, which when used together allow the owner to initiate and sign electronic transactions. |

| Bitcoin Mining | Mining is intended to verify that new transactions are consistent with previously completed transactions. |

Is Bitcoin Worth An Investment?

You expose yourself to a volatile asset class by purchasing cryptocurrencies.

As a general rule, only a small portion of a diversified portfolio should be allocated to risky investments like Bitcoin or individual stocks.

Depending on your own situation, you may or may not find Bitcoin to be a profitable investment. Let’s examine some of Bitcoin’s benefits and drawbacks.

Pros:

- Reduces time and potential for a transaction

- Hig privacy rate

- Contains a decentralized currency

- Has a high growth potential

Cons:

- Prices change every year, which makes it volatile in nature

- A high number of profile hacks

- It is not protected by SIPC (Security Investor Protection Corporation)

What Is Robinhood?

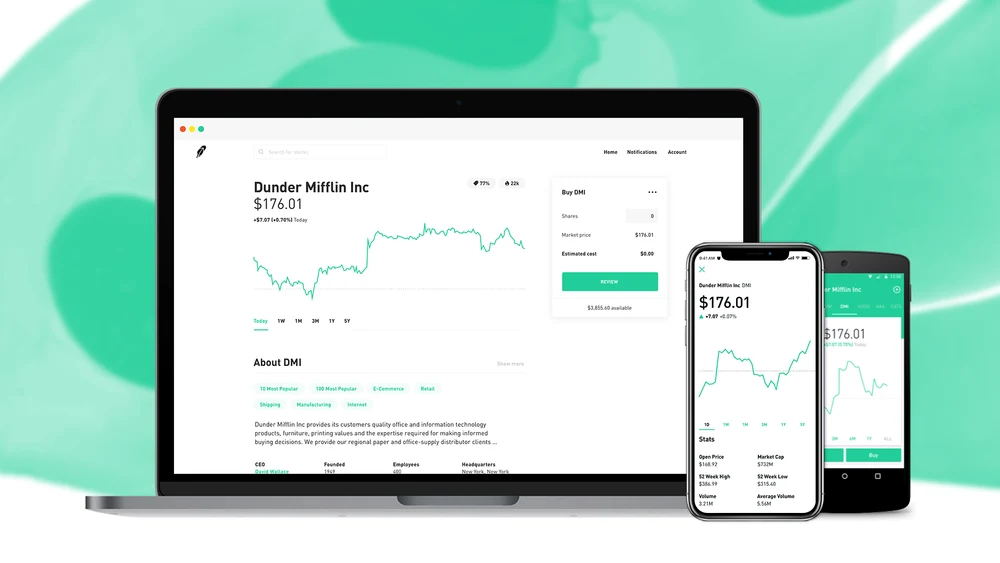

Compared to Coinbase, Robinhood entered the Bitcoin market relatively later. Although founded in 2013, Robinhood initially concentrated on the regular stock market rather than the cryptocurrency industry.

But, Robinhood’s original trading app’s emphasis on simplicity has helped them succeed in the cryptocurrency sector.

The program covers four main investing categories: Stock trading and exchange-traded funds (ETFs), options, margin investing, and cryptocurrency.

It’s simple to purchase a cryptocurrency using Robinhood. You simply choose which coin you wish to buy and then initiate the purchase.

What Is Coinbase?

The name Coinbase is widely recognized in the broader Bitcoin industry.

It was the first significant cryptocurrency exchange that made it quick and easy for customers to buy their first Bitcoin, and the business has carried that emphasis on user-friendliness all the way up to the present day.

Coinbase offers a Pro edition with more complex crypto trading capabilities in addition to straightforward cryptocurrency transactions, however, this version requires a separate account.

It offers a range of wallet options, including custodial and non-custodial wallets, and it also enables users to learn about new products and earn additional cryptocurrency tokens through the Coinbase Rewards program.

It was once one of the most expensive ways to purchase cryptocurrencies. However, the business has changed to a tiered maker/taker model for its price structure.

Difference Between Buying Bitcoin On Robinhood vs. Coinbase

Hundreds of cryptocurrencies are available on Coinbase and can be purchased, traded, and swapped. Robinhood only sells 15 coins, compared to more than 150 on Coinbase.

Robinhood is the best option for someone making their first investment, while Coinbase would be a better option for someone who wants to go a little deeper into the world of cryptocurrencies.

When you purchase or sell a coin on Robinhood, there are no transaction costs. On the other hand, Coinbase levies fees.

Although it was recently discovered they may have had a severe security issue in their early days, Coinbase insists they have never been hacked. On the other hand, Coinbase also permits customers to withdraw cryptocurrency to their personal wallets.

Robinhood doesn’t provide a mechanism for you to earn free cryptocurrency, whereas Coinbase does with its Earn tool.

One rather significant differential that is uncommon in the cryptocurrency exchange market is the fact that Robinhood enables customers to conduct all of their tradings (both bitcoin and equities) within a single app.

The main distinguishing quality of Coinbase is its capacity to integrate new customers into the cryptocurrency community.

Robinhood offers a crypto wallet option, but it’s completely custodial. On the other hand, Coinbase provides a variety of wallet choices.

Let’s summarize the whole context of differences based on Robinhood and Coinbase; the two platforms readily available to buy Bitcoin.

| Differences | Robinhood | Coinbase |

| Headquarters | Menlo Park, USA | San Francisco, USA |

| Year Established | 2013 | 2012 |

| Gold | Yes | No |

| Features | Wallet, and Instant Deposit | Wallet, Staking, Rewards, and NFTs |

| Fee Structure | No trading fee | Various fees based on the volume of the trades |

| Security | Medium | High |

| Proprietary Token | 7 | 28 |

| Properietary Token | No | Yes |

| Supported Transaction | Market order, and Limit order | Market order, Stop order, Limit order, and Coin-to-coin |

| Liquidity | N/A | $4.1 billion |

| Onsite Wallet | No | Yes |

| Funding Methods | ACH Bank Transfer | ACH Bank Transfer, Wire transfer, Cryptocurrency transfer, and PayPal |

Alternatives To Robinhood And Coinbase

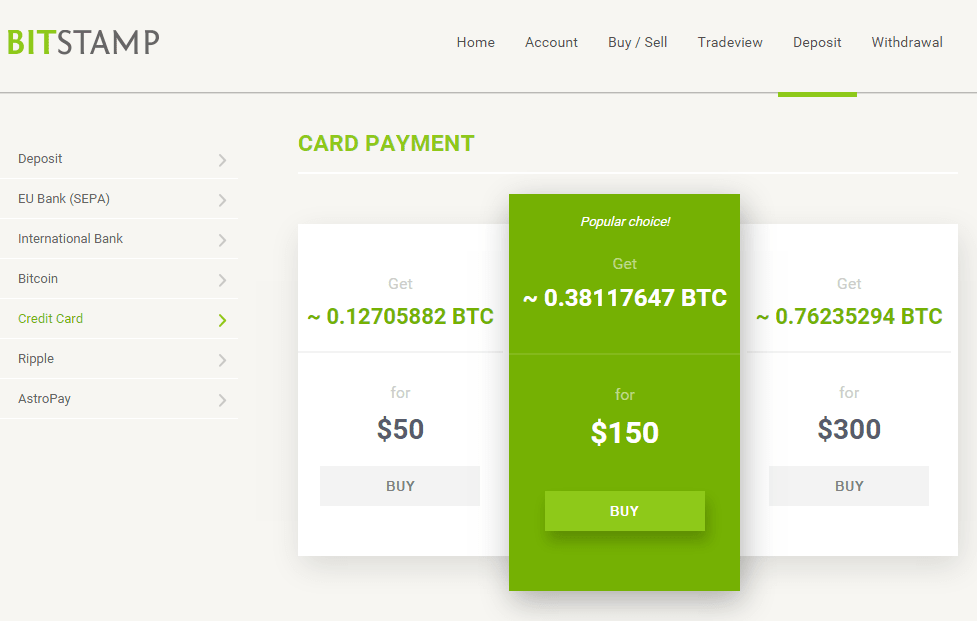

Bitstamp

One of the earliest venues to buy and sell Bitcoin was Bitstamp, a cryptocurrency exchange that was founded in 2011.

It’s an excellent choice for beginning and casual cryptocurrency investors wanting to purchase and sell with competitive prices and an easy-to-use interface.

With competitive trading costs, it now supports traders wishing to purchase and sell a list of 81 cryptocurrencies and counting.

Bitstamp has an active trading platform on the Internet or via mobile apps.

Kraken

One of the oldest cryptocurrency exchanges available is Kraken, which was formed barely two years after Bitcoin (BTC).

Its high security, minimal trading costs, and solid range of available cryptos make it a suitable alternative for investors who are just exploring crypto as well as more experienced traders.

Kraken provides a platform with the highest level of security and more than 120 coins to pick from in the United States, even though the oldest isn’t always the best.

Conclusion

- For newbies, Robinhood and Coinbase are incredibly simple to use. Both have user interfaces that are straightforward and let you see exactly what you’re purchasing. Each also offers a mobile app for iOS and Android smartphones.

- Both Robinhood and Coinbase make it easy to purchase cryptocurrency using fiat money. Yet while Coinbase is a legitimate cryptocurrency exchange, Robinhood is a brokerage that also offers access to a few select coins. As a result, when utilizing Coinbase, you have additional choices for crypto assets.

- You’d be better off sticking with Robinhood for the time being if you already have an account there and are considering trading cryptocurrency for the first time.

- Yet if you want to withdraw your cryptocurrency holdings into your personal cryptocurrency wallet, Robinhood is not the ideal alternative for you.