In today’s modern, technologically advanced age, almost everyone is competing to make the most money and lead the greatest life possible. Amid confusion and competitiveness, having a bank account becomes essential.

With a bank account, you can make purchases without having cash on hand and easily receive direct deposits from your work or other institutions.

The available balance of a checking account refers to the amount that the account user can promptly withdraw. Contrarily, any pending transactions that haven’t yet been cleared are included in the current balance.

Keep reading to know more about checking accounts, and the differences between an available balance and a present balance.

Everything You Need To Know About Chase Bank

One of the top national banks is Chase, which provides a variety of checking accounts. What benefits you want and whether you can forgo the monthly cost could determine which option is best for you.

If you’re looking for a cash incentive, Chase is a fantastic choice because several of its checking accounts are highlighted in our guide to the greatest bank account bonuses.

Simply start each day with $1,500 in your account, make a monthly electronic deposit of $500, or have an average daily balance of $5,000 across all of your Chase accounts. You might also be eligible for a $200 incentive.

With Chase Premier Plus CheckingSM, you receive additional benefits, such as four monthly out-of-network ATM charge waivers.

If you are not eligible to receive a waiver of the fee, you will have to pay a $25 monthly service fee. There is no cash incentive.

What Is A Checking Account?

An account type known as a checking account makes it easy to withdraw, deposit, and transfer funds.

Checks, automated teller machines (ATMs), and electronic debits are just a few of the ways that checking accounts, also known as demand accounts or transactional accounts, can be accessed.

Writing checks is a common banking service that gave rise to the name-checking account; it is known as a current account in the UK and many other nations.

With a bank or other financial institution, such as a credit union, a person can open a current account.

What Is A Chase Checking Account?

A full-service financial institution, Chase Bank has more than 4,700 branches spread over the whole United States. It provides a range of goods and services, including credit cards, loans, and checking and savings accounts.

The five checking accounts offered by Chase are Chase Total Checking, Chase Secure BankingSM, Chase Premier Plus CheckingSM, Chase Sapphire Banking, and Chase Private Client.

| Different Types of Chase Checking Account | Description |

| Total Checking | No minimum deposit is required to open the account, but there is a $12 maintenance charge each month. |

| Secure Banking | There are no overdraft fees on this one. In addition, it offers free cashier’s checks, fee-free money orders, and early access to direct deposits. |

| Premier Plus Checking | It is generally a good checking account for waiving fees and is designed for individuals who have a lot of savings. |

| Sapphire Banking | This account has a $25 monthly maintenance cost and pays 0.01% APY. |

| Private Client | It offers advantages found in lower-tier Chase checking accounts, such as an APY of 0.01% (as of June 30, 2023). |

Chase also provides checking accounts for children and students in addition to these fundamental and premium checking accounts, including:

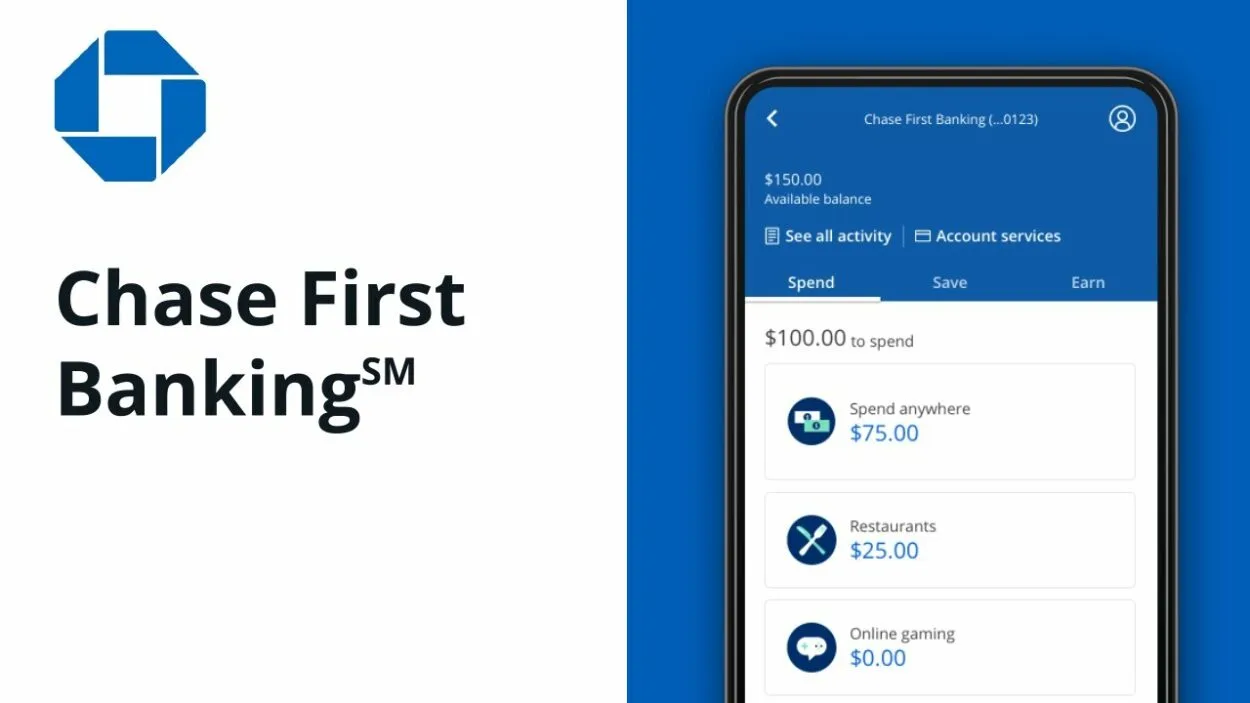

- Chase First Banking

- Chase High School Checking

- Chase College Checking

In addition to having facilities throughout the country, Chase now offers convenient mobile banking. Customers can see monthly statements, deposit checks, pay bills, and transfer money via Zelle through online banking.

Customers can bank from their smartphones by using the well-regarded Chase mobile app.

What Is Available Balance?

Like your current balance, you may typically check your available balance online, using a mobile app, at an ATM, or by visiting a bank teller.

Occasionally, your available balance may differ from your current balance, particularly if you recently deposited a cheque or made a transaction, but the posting process took longer than expected.

More specifically, the bank may hold some or all of the funds you deposit in a check while it confirms the check’s validity and obtains funds from the bank that issued it.

What Is Present Balance?

You can most likely find out what your balance is right now by checking your online account using a web browser or mobile app.

Additionally, you can find out the information by going to your neighborhood bank, interacting with a teller, or using an ATM.

Knowing your current balance helps you get a sense of how much money you have on hand right now. It will offer you a general notion of how much money you can spend if you’re trying to budget for the upcoming week or month.

Difference Between The Available Balance And The Present Balance In A Chase Checking Account

The difference between a bank account’s available balance and current balance can be one of the biggest sticking issues for customers.

This distinction can have a significant impact on the amount of money you have available as more people switch from manually balancing a checkbook to Internet banking.

The total quantity of money in your bank account is shown by its current balance. However, that does not imply that it can all be spent.

Different Types Of Bank Accounts

Fixed

A fixed deposit account is one where funds are deposited for a predetermined amount of time.

The person might obtain his money from the bank when the period has passed. A fixed deposit often offers a higher interest rate than a savings account.

As an illustration, an 8% deposit made for 5 years is withdrawn after 2 years. Interest will be paid at 5% if the rate in effect on the day of deposit is 5% for two years. Banks have the right to impose penalties for early withdrawal.

Savings

An account where you can quickly deposit money and receive interest will help you save for a certain financial goal.

You can increase your savings by earning interest on your balance. You can accept money transfers from banks and other persons as well as have your pay put into the account.

It offers a safe place to save money, and interest can be accumulated over time. This account is simpler to set up and has easy access to the money.

Conclusion

- The difference between a bank account’s available balance and current balance can be one of the biggest sticking issues for customers. This distinction can have a significant impact on the amount of money you have available as more people switch from manually balancing a checkbook to Internet banking.

- The current balance is the total amount of money held in the account whether you see your bank account online or chat with a branch teller. This may not be the most accurate representation of your account’s condition, as you will soon discover.

- The amount of money in your account less any credits or debts that haven’t finished posting to the account is your available balance. Although it might accurately represent the money you have available, this is the maximum amount you can spend.

- When you check the balance of your account, you can discover that these two figures are not the same. The current balance will exceed the available balance if you recently made purchases with your debit card but the financial institution hasn’t completed the transaction. The same applies if your cheque has been written but hasn’t yet cleared.